Positive Momentum Further Expands in September, Including Complete Job Recovery

-

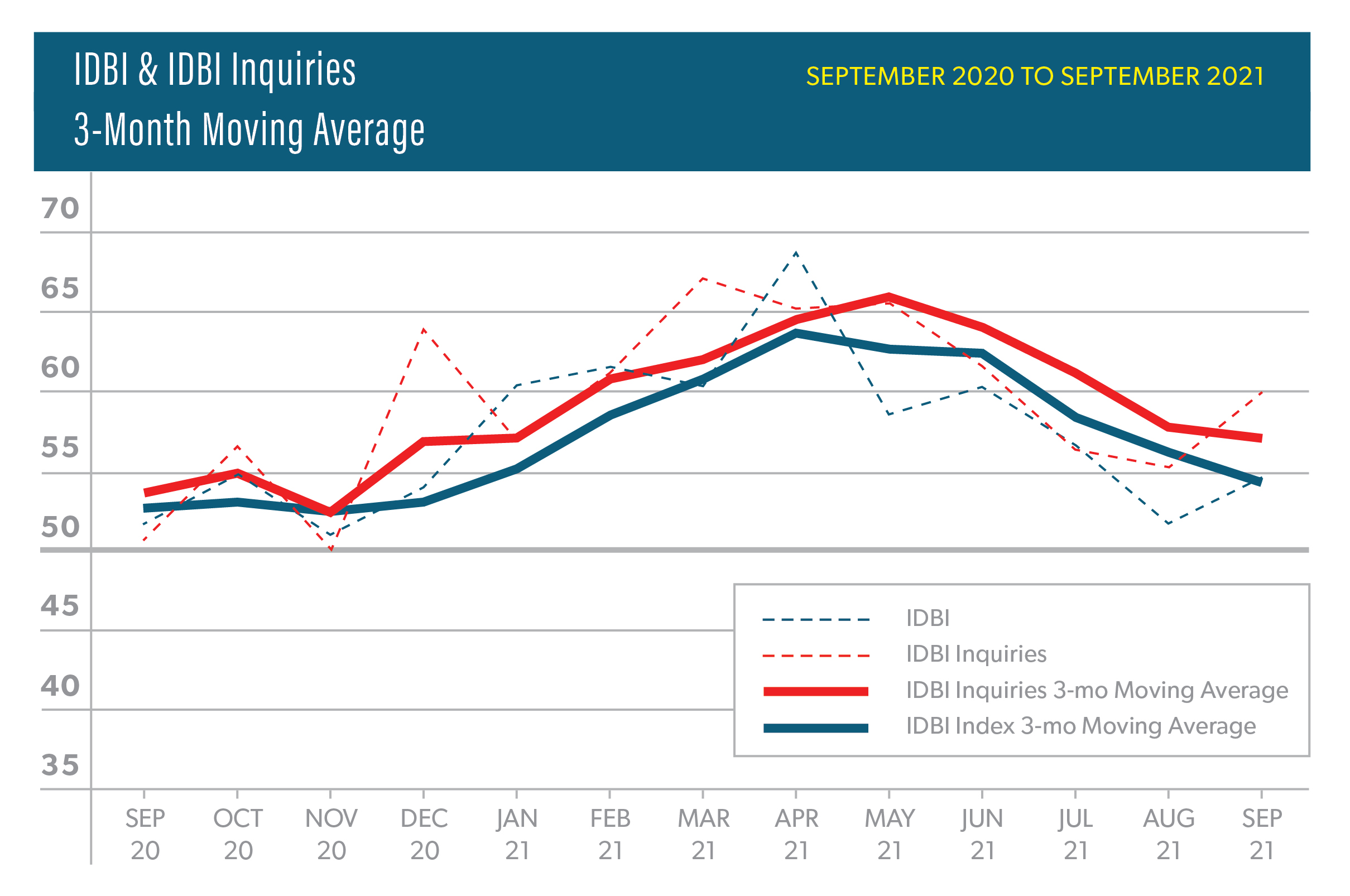

September has stopped the downward trend over the last two months with all the indices increasing from their August readings. This is the first time since February 2021 that all three indices simultaneously experienced month-over-month increases.

-

Billings index* improved almost three points to 54.6 from September (51.7).

-

This is the 15th consecutive month where the billings index is in expansion territory (i.e., above 50) and the fourth longest run in the survey’s history.

-

The three-month moving average (54.3) decelerated almost two points from September, but still remains in growth mode.

-

-

For the second consecutive survey, the highest three-month moving average was in the Midwest (59.9) followed by the South (55.4). The Northeast (51.2) bounced back into positive territory after dipping below 50 in August while the West (47.8) fell below 50 for the first time since November 2020.

-

Inquiries index* improved 4.4 points to 59.8, which is the largest month-over-month increase since March 2021.

-

The three-month moving average remained stable at 57.1, decreasing about a half of point from August.

-

-

The six-month outlook for interior design business experienced the smallest gain out of the three indices, but still increased 0.2 points to 61.5 for September.

-

Supply chain and product availability continue to be top concerns for interior design firms as summed up by a panelist: “Hopefully the supply chain will cooperate also so we will be able to get more product sooner rather than later”

-

-

-

Changed products/materials (45%) and increasing project budget (43%) were the top strategies for handling additional costs associated with increased lead times.

-

When asked about the challenges experienced when hiring contractors for projects, 75% expressed availability (i.e., schedule) as their top challenge followed by finding skilled workers (67%) and costs (52%).

-

Over 89% anticipate these challenges to persist for at least six months with one panelist indicating that, “it's been an ongoing problem for years [and] the sudden increase in need has just magnified the issues.”

-

*Note: Any score above 50 represents expansion (i.e., growth) and below 50 represents contraction (i.e., decline).

Important Economic Indicators

-

Employment Updates:

-

As of September 2021, overall employment recovered 17.4M or 84% of the jobs lost from March 2020.

-

As of August 2021, Interior Design services has completely recovered all the jobs lost from March 2020.

-

However, the profession is still 2.6K jobs away from pre-pandemic high achieved in October 2019 (50K).

-

-

As of August 2021, Architectural services recovered 8.3K or 92% of jobs lost from March 2020.

-

-

Producer Price Changes (as of September 2021):

-

Lumber (softwood) decreased 40.3% over the last 12 months (down 176.0% from June)

-

Flooring increased 16.5% over the last 12 months (down 0.6% from June)

-

Textiles & Fabrics increased 17.3% over the last 12 months (up 1.2% from June)

-

Furniture – residential increased 11.0% over the last 12 months (up 3.6% from June)

-

Cabinetry increased 2.9% over the last 12 months (up 0.9% from June)

-